Content

Liquidity management consists of two steps that require different techniques to achieve their objectives. The first step is to get an overview of the current and past cash flow; the second step is to design a plan for the expected future cash flow. Liquidity management is one of the main pillars of a company’s financial management, because it Proof of space ensures solvency.

Liquidity Management: An Introduction

If cash inflows are lower than forecasted, it can mean that you won’t be https://www.xcritical.com/ able to pay your suppliers, lenders, or other obligatory payments. Credit risk can result in the need to sell illiquid assets at a lower price than their fair value. A continuous inability to pay debt and suppliers over a longer period can even cause insolvency. Being able to see the full financial picture is the foundation of effective liquidity management.

- In general, high-volume traders, in particular, want highly liquid markets, such as the forex currency market or commodity markets with high trading volumes like crude oil and gold.

- The project also involved migration of the data from current liquidity systems to the new systems.

- Let us share with you our decades-long expertise in banking modernization and digital transformation and take your liquidity management to another level.

- To evaluate your liquidity risk, you simply compare your liquid assets to your short-term liabilities.

- He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

What Are the Types of Liquidity?

Each company has its own objectives for liquidity management, but there are a few common ones that generally apply and should be considered by finance and treasury teams. For treasurers and finance teams, especially those in multinational companies, ‘trapped cash scenarios’ can cause serious liquidity risk, and can easily lead to bad investment choices. This could involve asking customers to pay upfront, or even offering liquidity soft solutions forex a discount for early payments.

Credit Facilities and Lines of Credit

Having a good liquidity management strategy helps companies have positive working capital and efficient cash flow. In addition to helping organizations meet debt obligations with their liquid assets, good liquidity also helps businesses attract investors and gain the trust of lenders. Furthermore, liquidity helps companies determine whether they’re ready to make investments to increase their turnover. For this purpose, the finance and treasury departments develop a strategy of making sufficient cash available without jeopardizing the company’s ability to meet its financial obligations. Thus, to understand their liquidity, companies need to know how quickly they can turn their short-term assets into cash as well as when their medium- and long-term assets will pay off.

To create a successful liquidity management plan, companies must balance accessibility needs with return requirements. This often involves separating cash reserves by the timeframe in which they are needed. In order to reach excellent liquidity management, companies must effectively manage their liquidity to gain transparency and visibility of their cash inflow and outflow to keep a constant pulse on their receivables and liabilities. They can even employ cash flow tracking solutions to track their cash flow automatically. Accurate data will also help them anticipate future obligations and create liquidity plans accordingly.

Supply chain management is the process of coordinating the flow of goods and resources from suppliers to customers. It is a complex process that involves managing multiple moving parts, including raw materials, inventory, finished products, transportation, and logistics. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

Investors and traders manage liquidity risk by not leaving too much of their portfolios in illiquid markets. In general, high-volume traders, in particular, want highly liquid markets, such as the forex currency market or commodity markets with high trading volumes like crude oil and gold. Smaller companies and emerging tech will not have the type of volume traders need to feel comfortable executing a buy order. For accounts receivable, this may involve implementing policies, such as requiring customers to pre-pay for orders or offering discounts for early payment. Similarly, there are several ways to improve accounts payable management, such as negotiating longer payment terms with suppliers and taking advantage of early payment discounts. However, there are a number of factors that can impact a company’s working capital and, as a result, its liquidity.

Predictive analytics allows for unlocking the full potential of gigabytes of data and hundreds of indicators that banking liquidity depends on. All of the factors above mean one thing — old approaches to liquidity management may not be as efficient anymore. Prochanow in 1944 on the basis of the practice of extending term loans by the US commercial banks. This theory states that irrespective of the nature and feature of a borrower’s business, the bank plans the liquidation of the term-loan from the expected income of the borrower. A term-loan is for a period exceeding one year and extending to a period less than five years.

One way to manage adequate inventory levels is to implement just-in-time inventory management. This minimizes the amount of inventory on hand by only ordering what is needed to meet customer demand. Basel III is a set of international banking regulations aimed at enhancing the global financial system’s stability. Establish an analytic framework for calculating risk, optimizing capital and measuring market events and liquidity. Cash provides a more comprehensive picture of the company’s short-term financial situation by accounting for both immediately available resources and those that can be quickly mobilized.

Lockbox services provided by banks involve collecting and processing customer payments on behalf of a company, accelerating the collection of receivables and enhancing cash flow visibility. Cash flow cycles, which represent the time it takes for a company to convert its investments in inventory and other resources back into cash, can also affect liquidity management. Liquidity management is important for the financial health and stability of businesses.

Reliable cash flow management builds trust with suppliers, vendors, employees, and stakeholders by ensuring timely payments and financial stability. Consistently paying suppliers and vendors on time fosters a reputation for reliability. This reliability can lead to better credit terms, discounts, and stronger partnerships. In this blog, we will understand cash and liquidity management, its importance, and five key cash and liquidity management strategies for managing business financial health. With an increasing number of banks, accounts, suppliers, customers, ERP systems, subsidiaries, employees, processes, and excels, it becomes challenging to manage liquidity.

In all cases, a higher ratio is better as it shows that a company has a greater ability to meet its financial obligations. Companies with longer cash conversion cycles may require more extensive liquidity management measures to ensure adequate cash availability. Market conditions, such as economic cycles, interest rate environments, and geopolitical events, can influence liquidity management by affecting the availability and cost of credit and the demand for products and services. This can lead to a distorted view of the amount of working capital available to the firm.

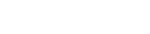

Banks need real-time data to make the most out of all the liquidity management strategies above. After all, there’s no longer a substantial time lag between sending and receiving payments in banking. There’s a toolkit of metrics to help the treasury department understand the level of liquidity.

From a liquidity perspective, it is critical to manage accounts receivable and payable carefully, which means ensuring that invoices are sent out in a timely manner and payments are collected promptly. Maintaining a strong cash position is critical for any company, but it is especially important for businesses that operate on tight margins. For these companies, even a small dip in cash flow can have a significant impact on operations.

This theory dominates the commercial loan theory and the shiftability theory as it satisfies the three major objectives of liquidity, safety and profitability. Liquidity is settled to the bank when the borrower saves and repays the loan regularly after certain period of time in installments. It fulfills the safety principle as the bank permits a relying on good security as well as the ability of the borrower to repay the loan.